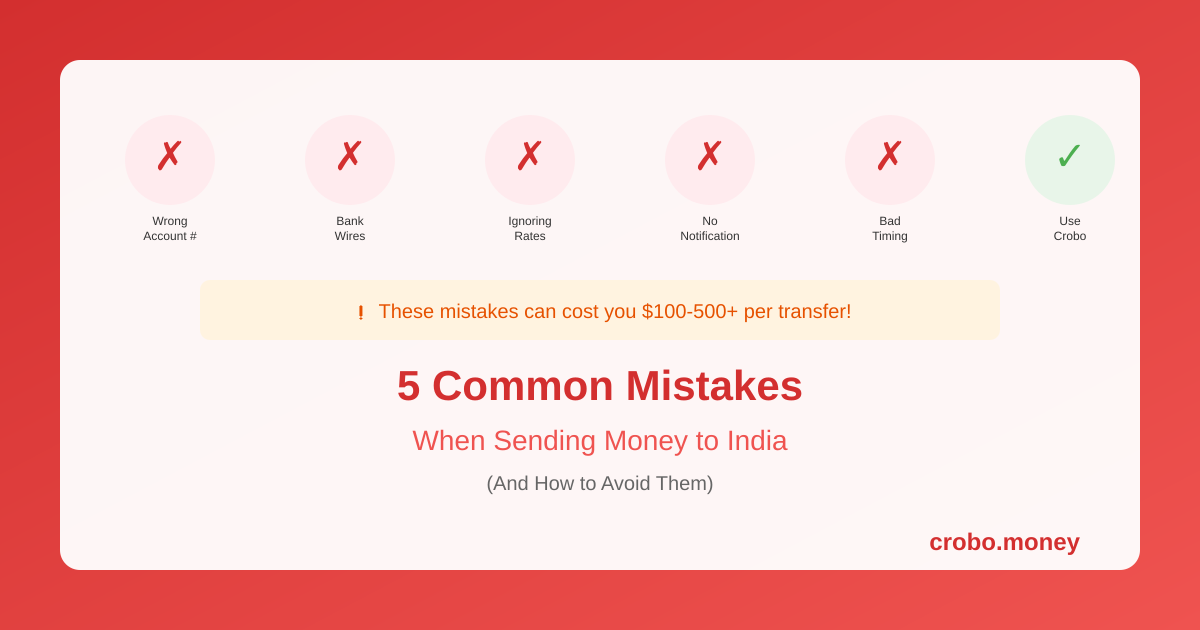

A small mistake in your money transfer can cost you hundreds of dollars or delay funds when your family needs them most. After handling millions of transfers, we’ve identified the most common errors NRIs make when sending money to India. Here’s how to avoid each one and ensure your transfers go smoothly every time.

Mistake #1: Wrong Account Number or IFSC Code

This is the most common and potentially costly error. Typing a wrong digit can send money to a stranger’s account or cause the transfer to fail. Always have your recipient confirm their account number from their bank passbook or online banking, not from memory. Verify the IFSC code matches their exact branch since banks with multiple branches in a city have different codes. Double-check before submitting because most services show a confirmation screen. For regular recipients, save their details after the first successful transfer.

Mistake #2: Using Bank Wire Transfers for Small Amounts

Bank wires typically cost $45-50 per transfer plus poor exchange rates. For a $500 transfer, you might lose 15-20% to fees and rates. The fix is simple: use online remittance services for amounts under $10,000. Services like Crobo charge zero fees on ACH transfers and offer near mid-market rates. Reserve bank wires only for very large amounts where specialized service may be needed.

Mistake #3: Ignoring Exchange Rate Differences

Two services might both advertise “low fees” but offer vastly different exchange rates. A 2% rate difference on $5,000 means ₹8,400 lost. The solution is to always compare the final INR amount received, not just the fees. Check the current Google rate as your benchmark. Use comparison tools or calculate manually to ensure you’re getting the best deal. What you pay includes both visible fees and the exchange rate spread.

Mistake #4: Not Informing Your Recipient

Unexpected deposits can cause confusion or even rejection. Your recipient might not check their account for days or mistake the deposit for something else. For large amounts, banks may hold funds pending verification. Always tell your recipient the expected amount in INR, the approximate arrival date, the sender name as it will appear, and how to contact you if there’s an issue. A quick WhatsApp message can prevent unnecessary worry.

Mistake #5: Transferring During Rate Fluctuations Without Awareness

Sending money right after major economic announcements can mean poor rates. US Fed rate decisions, India RBI policy updates, and global market volatility all impact USD/INR. While you can’t time the market perfectly, you can avoid known volatility periods for non-urgent transfers. Set up rate alerts to be notified of favorable movements. For large amounts, consider splitting across multiple transfers to average out rate fluctuations.

Bonus Mistake: Using the Wrong Account Type

Sending US income to an NRO account instead of NRE creates tax complications and repatriation limits. Ensure you’re sending to NRE for foreign-earned income. NRO should only receive India-sourced income like rent or dividends. If you’ve made this mistake, consult a CA in India about correcting the record.

A Pre-Transfer Checklist

Before every transfer, confirm these items. Is the account number correct with all digits verified? Is the IFSC code for the right branch? Does the recipient name match exactly with the bank account? Am I getting a competitive exchange rate compared to Google? Have I informed my recipient about the incoming transfer? Is this going to the correct account type, NRE or NRO?