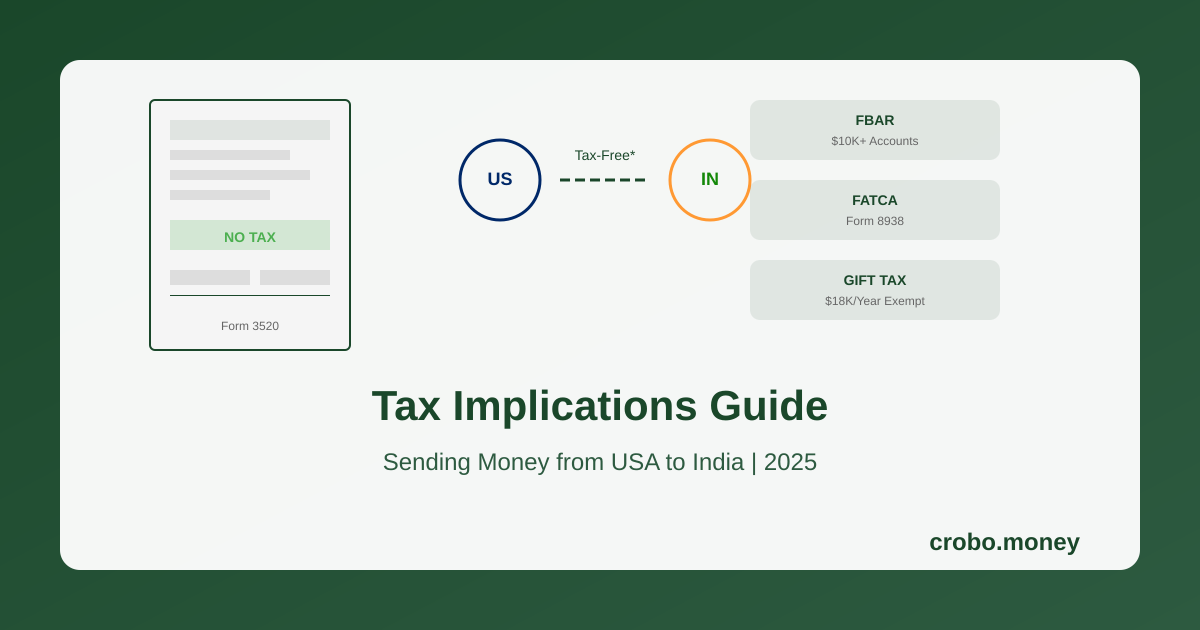

Will you be taxed for sending money to India? It’s one of the most common questions NRIs ask, and the answer is usually “no, but it depends.” This guide demystifies the tax implications on both sides of the transfer, helping you stay compliant while avoiding unnecessary tax burdens.

The Basic Rule: Sending Taxed Income Isn’t Taxable Again

Here’s the fundamental principle: money you’ve already paid US taxes on is not taxed again when you send it to India. Your salary after withholding, your savings, your investment returns after capital gains tax—all of this can be transferred to India without additional US tax. India generally doesn’t tax incoming remittances from abroad either, with some exceptions for gifts to non-relatives.

US Tax Considerations

From the US perspective, the main considerations are gift tax rules, FBAR (Foreign Bank Account Report) requirements, and FATCA (Foreign Account Tax Compliance Act) reporting. None of these typically result in additional tax for straightforward remittances, but failing to comply can result in severe penalties.

Gift Tax: When It Applies

If you’re sending money to family members as a gift (not for their services or as payment), US gift tax rules apply. You can give up to $18,000 per person per year (2024) without filing any forms. Above that, you file Form 709 but won’t owe tax unless you exceed your lifetime exemption. Married couples can gift up to $36,000 per person jointly. Remember: filing a form doesn’t mean paying tax.

India Tax: Is the Recipient Taxed?

India’s Income Tax Act generally exempts gifts received from relatives, regardless of amount. Relatives include parents, siblings, spouse, and their families. Gifts from non-relatives exceeding ₹50,000 in a financial year are taxable as “Income from Other Sources.” So sending money to parents or siblings results in zero Indian tax. Sending to a friend could trigger tax liability for them.

FBAR Requirements: Don’t Ignore This

If your foreign financial accounts (including Indian bank accounts) exceed $10,000 at any point during the year, you must file FBAR (FinCEN Form 114) by April 15 with automatic extension to October 15. This is a reporting requirement, not a tax. Penalties for non-compliance are severe: up to $12,500 per account per year for non-willful violations, and much more for willful violations. File even if you’re unsure whether you meet the threshold.

FATCA Reporting: Form 8938

FATCA requires reporting specified foreign financial assets on Form 8938 if they exceed certain thresholds: $50,000 on the last day of the year or $75,000 at any time for single filers living in the US. Thresholds are higher for married couples and those living abroad. This overlaps with FBAR but has different thresholds and is filed with your tax return.

Record-Keeping Best Practices

Maintain detailed records for at least seven years including transfer receipts from services like Crobo, bank statements showing source of funds, purpose documentation for large transfers, and exchange rate confirmations. This protects you in case of IRS inquiry and simplifies annual tax filing.

Working with Tax Professionals

If you’re sending large amounts regularly, consider consulting a CPA familiar with international taxation. They can help optimize your transfer strategy, ensure compliance with reporting requirements, and navigate complex situations like sending money for property purchases or business investments. The cost of professional advice is usually far less than potential penalties for non-compliance.